yo

u have something like this for EU..where did u get this from? thanks

u have something like this for EU..where did u get this from? thanks

Yes, I will post for EU. I took Britsimon may 1 data. Already post AF Summary in same format.yo

u have something like this for EU..where did u get this from? thanks

yo

u have something like this for EU..where did u get this from? thanks

As I read your post again, it appears to me that you probably ment "reducing the highest case number" for Nepal. But than you talk about 13350. So anyway, even if I do not really have a dissenting opinion, there are my thoughts.So - Nepal cases are more dense this year and each Nepalese case has a higher response rate and an extremely high approval rate. SO - that means they will hit their limit faster and it has the effect of reducing the highest case number. Hitting 13350 again has always looked doubtful to me once I saw the entry data (just a couple of months ago).

As I read your post again, it appears to me that you probably ment "reducing the highest case number" for Nepal. But than you talk about 13350. So anyway, even if I do not really have a dissenting opinion, there are my thoughts.

I my mind, Nepal does not affect finals, given that KKC is committed to fill the quota. As last year, it looked like they were slowing down Asia, but they weren't, judging by the fact that the quota was reached (I do not know how reliable the info on the quotas that we have). If KCC thought that Nepal would be in the way of the VB progress, they would put a limit on the country the way they do in other regions.

No matter how many selectees they pick from Nepal as long as they reach 3500 visas, there is no effect on the finals. Whether there are more or less Nepalese cases beyond the cut-off, the density of the remaining ROA does not change. Of course, the ROA entries proportion will determine the density mix beoynd Nepalese cut-off. As you said, Nepal higher density means earlier cut-off for Nepal.

Before the earthquake, I was hoping that they would keep up the issuance pace, so that they would reach 3500 faster and VB progress would accelerate earlier. Now however, it looks like KCC anticipates the AS progress could be in question. Thus, they limited Nepal. In my estimation though, Nepal would not go much higher than CN7000 to issue 3500 visas (with the density and the response rate of 83% in mind).

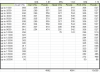

This is how selection would look like based on population of entries data:

View attachment 501

(This is mostly to visualize the selection, It is not intended for making estimates regarding finals. For ROA CNs proportion before 9000, I used some average of the actual CNs data after 9000)

It confirms your insight that having more derivatives means earlier selection limit and fewer CNs. However, the population proportions and derivatives ratios would not be too representative of the samle of selectees. From the density data, I figure the proportions would look more like Iran 32.5%, Nepal 37.5%, ROA 30% of the actual selected CNs. It could mean that most seleciton disqualification comes from ROA. Also, from CEAC data so far, it looks like the derivative ratios are almost consistently higher for all the three entities Iran 2, Nepal 1.82, ROA 1.89.

The respose rate so far is quite interesting Iran 69%, Nepal 83%, ROA 44%. With this response rate and a conservative AP estimate, Iran would not have enough people for 3000 visas.

My private estimation for ROA still looks too grim to publicize, and I am too scared of siliconslinger's wrath. However, it is all just my babble, and how the most critical unknown variable unfolds (Iran's AP) remains to be seen.

Please sir, can you PM your estimation for final AS cutoff. I'm literally dying over here. I would really appreciate it, if it's no trouble for you...As I read your post again, it appears to me that you probably ment "reducing the highest case number" for Nepal. But than you talk about 13350. So anyway, even if I do not really have a dissenting opinion, there are my thoughts.

I my mind, Nepal does not affect finals, given that KKC is committed to fill the quota. As last year, it looked like they were slowing down Asia, but they weren't, judging by the fact that the quota was reached (I do not know how reliable the info on the quotas that we have). If KCC thought that Nepal would be in the way of the VB progress, they would put a limit on the country the way they do in other regions.

No matter how many selectees they pick from Nepal as long as they reach 3500 visas, there is no effect on the finals. Whether there are more or less Nepalese cases beyond the cut-off, the density of the remaining ROA does not change. Of course, the ROA entries proportion will determine the density mix beoynd Nepalese cut-off. As you said, Nepal higher density means earlier cut-off for Nepal.

Before the earthquake, I was hoping that they would keep up the issuance pace, so that they would reach 3500 faster and VB progress would accelerate earlier. Now however, it looks like KCC anticipates the AS progress could be in question. Thus, they limited Nepal. In my estimation though, Nepal would not go much higher than CN7000 to issue 3500 visas (with the density and the response rate of 83% in mind).

This is how selection would look like based on population of entries data:

View attachment 501

(This is mostly to visualize the selection, It is not intended for making estimates regarding finals. For ROA CNs proportion before 9000, I used some average of the actual CNs data after 9000)

It confirms your insight that having more derivatives means earlier selection limit and fewer CNs. However, the population proportions and derivatives ratios would not be too representative of the samle of selectees. From the density data, I figure the proportions would look more like Iran 32.5%, Nepal 37.5%, ROA 30% of the actual selected CNs. It could mean that most seleciton disqualification comes from ROA. Also, from CEAC data so far, it looks like the derivative ratios are almost consistently higher for all the three entities Iran 2, Nepal 1.82, ROA 1.89.

The respose rate so far is quite interesting Iran 69%, Nepal 83%, ROA 44%. With this response rate and a conservative AP estimate, Iran would not have enough people for 3000 visas.

My private estimation for ROA still looks too grim to publicize, and I am too scared of siliconslinger's wrath. However, it is all just my babble, and how the most critical unknown variable unfolds (Iran's AP) remains to be seen.

Please sir, can you PM your estimation for final AS cutoff. I'm literally dying over here. I would really appreciate it, if it's no trouble for you...

I do not have the numbers in front of me right now. Do you mean scheduled CNs per 1000 are similar for both years?Great explanation. But your actual CN count is total CN in this year. This year KCC have uploaded all the CN in upfront, but last they did not upload all the CN, they had uploaded only CN that are schedule for interview. When you look at both year CN count that are schedule for interview in thousand are almost same count.

I am sure siliconslinger is happy with my final cutoff

Still we need to wait for next VB to predict the final cutoff.

Total CN in 1000 for both year same total. But due to Nepal dense, Nepal got more total CN than ROA + Iran. if you look at my table carefully, you will notice that. By the way all ABD cases are not Iran cases. Here in UAE lot of Asian are working and they go for an interview in ABD. eg. I am from ROA (Sri Lanka) , I will have interview in ABD.I do not have the numbers in front of me right now. Do you mean scheduled CNs per 1000 are similar for both years?

From your table, Nepal is predictably are ahead of last year by issuance due to its own density.

However, Iran+ROA are quite behind. They have smaller proportion this year, and as we progress there will be more cases issued from those lower thousands. However, it still feels too low.

As Britsimon mentioned, the three embassies ABD, ANK and YRV went from ~500 to ~1000 issued in the last 6 weeks. We do not know the proportion of Iranian cases at those embassies, but it is probably significant. However, the absolute number of APs at those embassies has not been going down much, but has been slightly growing in the last several weeks.

The longer AP cases, I would imagine at some point, will start to clear, as the newer cases will go on AP. As you know, last year a massive number of APs and Ready were left out.

Britsimon has a secret insight into the AP length. I didn't look into his methodology, but I am sure it's solid. I am sure he will be looking into this soon, and may be remind us about his technique to do that.

As I read your post again, it appears to me that you probably ment "reducing the highest case number" for Nepal. But than you talk about 13350. So anyway, even if I do not really have a dissenting opinion, there are my thoughts.

I my mind, Nepal does not affect finals, given that KKC is committed to fill the quota. As last year, it looked like they were slowing down Asia, but they weren't, judging by the fact that the quota was reached (I do not know how reliable the info on the quotas that we have). If KCC thought that Nepal would be in the way of the VB progress, they would put a limit on the country the way they do in other regions.

No matter how many selectees they pick from Nepal as long as they reach 3500 visas, there is no effect on the finals. Whether there are more or less Nepalese cases beyond the cut-off, the density of the remaining ROA does not change. Of course, the ROA entries proportion will determine the density mix beoynd Nepalese cut-off. As you said, Nepal higher density means earlier cut-off for Nepal.

Before the earthquake, I was hoping that they would keep up the issuance pace, so that they would reach 3500 faster and VB progress would accelerate earlier. Now however, it looks like KCC anticipates the AS progress could be in question. Thus, they limited Nepal. In my estimation though, Nepal would not go much higher than CN7000 to issue 3500 visas (with the density and the response rate of 83% in mind).

This is how selection would look like based on population of entries data:

View attachment 501

(This is mostly to visualize the selection, It is not intended for making estimates regarding finals. For ROA CNs proportion before 9000, I used some average of the actual CNs data after 9000)

It confirms your insight that having more derivatives means earlier selection limit and fewer CNs. However, the population proportions and derivatives ratios would not be too representative of the samle of selectees. From the density data, I figure the proportions would look more like Iran 32.5%, Nepal 37.5%, ROA 30% of the actual selected CNs. It could mean that most seleciton disqualification comes from ROA. Also, from CEAC data so far, it looks like the derivative ratios are almost consistently higher for all the three entities Iran 2, Nepal 1.82, ROA 1.89.

The respose rate so far is quite interesting Iran 69%, Nepal 83%, ROA 44%. With this response rate and a conservative AP estimate, Iran would not have enough people for 3000 visas.

My private estimation for ROA still looks too grim to publicize, and I am too scared of siliconslinger's wrath. However, it is all just my babble, and how the most critical unknown variable unfolds (Iran's AP) remains to be seen.

Total CN in 1000 for both year same total. But due to Nepal dense, Nepal got more total CN than ROA + Iran. if you look at my table carefully, you will notice that. By the way all ABD cases are not Iran cases. Here in UAE lot of Asian are working and they go for an interview in ABD. eg. I am from ROA (Sri Lanka) , I will have interview in ABD.

Yes you are rightJust a point about spotting Iranians. Yes not all cases at the three embassies are Iranians BUT the displacement of Iranians of the last couple of decades means we could just as easily find them in Germany, Canada and so on. However, the AP rate in the 3 embassies is mostly due to Iranian cases - and the sudden acceleration is also clearly Iranian.

Dear BritSimon

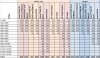

As you know I am using your CEAC data to generate few report to compare. Please see below report and tell me whether I understood correctly or missing some thing.

View attachment 500

Last year ROA + Iran issued visas are high than this year in each thousand.

This Nepal issued visas are higher last year in each thousand, so Nepal going to max early some where around ~7500 CN

It is my opinion this year ROA + Iran will go further down to 13K (May be 14K -15K). Is there any reason you think it will not more 13K

To be honest, my head hurts from tilting to understand the spreadsheet and because I made the mistake of reading your conclusion before the spreadsheet, my heart isn't really in it. SiliconeSlinger is not going to be happy.

Let's do the math again.

First the quota. I work on 8500, but we will probably only see about 8000 in CEAC due to AoS - and I will use AoS adjusted numbers for Nepal and Iran also.

So Nepal will max (3500 ish) so that is going to mean about 3300 from our 8000.

Iran is heading for 2700 to 3000. Let's call it 2700 in CEAC.

That leaves 2000 (optimistically) for ROA across the whole range. So how many thousands of cases does it take to fill 2000

In the May 1 file we could exclude the 3 embassies and KDU and find 588 issued as being ROA. In fact that excludes Asians like you, but even accepting that and knowing the max CN that could have been interviewed was 4725 - that showed a ROA rate of 125/1000. In reality I think that was at least 135 maybe even 140 (assuming 60/70 people like you getting lost from the 4 excluded embassies). OK we also know that number is maturing as DS260 backlog continues, so within the 4725 there will eventually be a few more cases not yet processed. To me it seems very probable that we will get to a issued rate of AT LEAST 150/100 - that would mean 710 ROA cases instead of the 588 the May 1 file shows.

OK - so if we take our optimistic 2000 and divide by our optimistic 150 per thousand we get almost exactly last years cut off. If the 150 becomes 160 we are at 12500. If the 150 is right, but we only have 1700 left for ROA we have 11300.

So - when I see 14/15k predictions I know something is wrong with the number work....

Thank you. Yeah my CN is in high-range 9,000 almost 10,000. I'm very afraid now that a faster AP clearance for Iran is confirmed. I wish you the best of luck!You have good chance since your cn in 9xxx series. We are talking about above 11xxx series.

I appreciate your comments a lot.Very good work. You have come to a number of conclusions that I don't think I have ever directly published mainly because I have some crazy spreadsheets that have all sorts of data that may or may not be relevant.

So let me pick out some of the things we agree on. I haven't checked the data against mine exactly - but I recognize certain findings.

Your entry spreadsheet is correct. We knew the limited countries and density as soon as they published the CEAC data, but it wasn't until the DV2015 entry data was published that we could figure out why the limits were different to last year. The flip of entries between Iran and Nepal was a surprise - and because of the response rate and success rate of the Nepal cases, not only was the Nepal density higher but the issued rate is much higher than we would originally expected. This has resulted in a big change from my original (January 1) Nepal cutoff numbers since we are now expecting Nepal issued rates around 450/1000 (I originally expected 380/1000). This will lead to a Nepal cutoff of 7000 to 7500. As you say this - this is largely academic for the broader Asia picture. I have made that point no end of times to SS and others in trying to point at Iran as being the real variable.

Your proportions of the density are correct and the assumption that the DQs were mainly ROA is correct also.

Your response rate splits are correct (as far as we see now). However Nepal (and Iran to some extent) are not going to increase, while ROA probably will. By that I mean the DS260 backlog is only an issue at all ROA.

Derivatives ratios globally have increased. People got married, had babies and so on. In some countries/regions this has been very significant - and in the end we will probably see that our 125K grew to 130/135k. So, your derivative numbers are correct.

Iran issued rate is most certainly accelerating. In the end it may not matter much whether the AP is a 3 month delay or a 4 month delay - the rolling nature of the issuances will maintain a pace. The pace will get Iran to 2700 and it should be noted that a lot of Iranians will be processing in other countries including the USA. The response rate is low I hear you cry - yes - but their selectee count became ~5350 because of additional derivatives. So - they have enough to hit 3000 - and that is enough to leave very slim pickings for ROA (and I agree on the grim view).

ROA issued numbers/1000 are very low right now. I do expect that to climb however as their response rate is maturing.

I think that covers it - let me know if I missed anything.

I do not see that you have reason to be afraid.Thank you. Yeah my CN is in high-range 9,000 almost 10,000. I'm very afraid now that a faster AP clearance for Iran is confirmed. I wish you the best of luck!