aninha1415

New Member

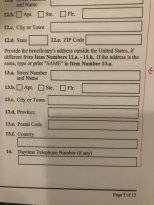

On the form i485 they ask if you are exempt from the public charge ground of inadimissibility. I can answer yes or no. But even after reading again and again the instructions I am not sure about the correct answer (the word exempt followed by the word inadimissibility is making me very confused)

I don’t know if I should answer yes or no for this question

I DO know that I need to file the i-944 because I am a immediate relative spouse of an us citizen and

I also need to file the i864 because I am not exempt under the list they provide

I never received any public benefit though

I don’t know if I should answer yes or no for this question

I DO know that I need to file the i-944 because I am a immediate relative spouse of an us citizen and

I also need to file the i864 because I am not exempt under the list they provide

I never received any public benefit though